Why Sourcing PE-Backed Companies Is Harder Than It Looks

For dealmakers, from investment banks to PE teams and corporate M&A to consultants, few things are more valuable than knowing which companies in a sector are backed by private equity.

These businesses are capitalized, professionalized, and — most importantly — on a predictable path toward an eventual sale.

That makes them some of the most actionable opportunities in the market, whether you’re building a roll-up strategy, mapping potential acquirers, or analyzing which companies have the financial firepower to drive deals in a niche.

Traditional methods miss mid-market players and slow down origination

Traditional databases like PitchBook or CapIQ are helpful but often miss mid-market players. Manual methods, such as Googling press releases, translating local filings, or scraping LinkedIn, are slow, inconsistent, and prone to blind spots.

For an analyst racing to prepare a buyer list or a roll-up thesis, that inefficiency can be the difference between winning and losing a mandate.

This article explores how leading investment banks and deal teams are solving the sourcing challenge: why PE-backed companies are such valuable targets, where traditional methods fall short, and how AI-native deal sourcing is transforming speed and accuracy.

Why PE-Backed Companies Matter for Dealmakers

Private equity ownership creates both predictability and urgency in the deal cycle.

Funds typically hold portfolio companies for three to seven years before seeking an exit, whether through a secondary buyout, a strategic acquisition, or an IPO. This built-in exit horizon makes sponsor-backed firms a consistent source of opportunities for investment banks.

The scale of this activity is significant. Over the long term, private equity has consistently outperformed public markets. Vanguard’s 2025 outlook projects a 10-year median annualized return of 8.9% for global PE, compared to just 5.4% for global public equities.

The implication is clear: superior returns are driven by frequent and profitable exits. For bankers, this means sponsor-owned companies are rarely dormant; they are actively managed toward a liquidity event.

Sponsor ownership is the common thread across buy-side roll-ups, sell-side buyer mapping, and broader market coverage

- On the buy-side, PE-owned companies are natural consolidators. They have professionalized management, available capital, and a mandate to execute roll-up strategies.

- On the sell-side, mapping which peers are sponsor-backed helps deal teams build targeted buyer lists and anticipate acquisition logic.

- Even in market mapping, knowing which companies have PE ownership is a marker of who has the resources and ambition to expand, and who is most likely to transact.

In short, identifying sponsor-backed firms isn’t just research housekeeping. It directly improves pipeline quality, sharpens client pitches, and positions dealmakers ahead of competitive processes.

The Limits of Traditional Research

Until recently, most dealmakers relied on a mix of subscription databases, manual research, and networks to piece together lists of sponsor-backed firms. Each approach has value, but all have gaps.

Databases like PitchBook and CapIQ provide structured information on ownership and deal history, but their coverage of the mid-market can be incomplete. Analysts often find themselves validating results with Google searches or local registries. Press releases and industry news offer another path, but scanning, translating, and verifying ownership information is tedious and error-prone. Even broker networks and industry contacts, while invaluable for proprietary insight, rarely provide comprehensive coverage.

The result is a workflow that can stretch into days or weeks. For junior teams tasked with compiling buyer or target lists, this time sink is enormous. More importantly, it carries strategic risk: missing one sponsor-backed player in a niche can mean missing the buyer who will ultimately close the deal.

How Leading Firms Are Changing the Process

Forward-looking M&A teams are beginning to change how they approach this problem. Rather than treating sourcing as detective work, they are building repeatable, scalable processes that combine AI-driven search with traditional judgment.

- Edgehill Management used AI-native deal sourcing to cut the average acquisition search time by 40%. They identified, evaluated, and closed their acquisition, Life Science Connect, in just 12 months, compared to a 20-month industry median.

- Lexar Partners increased its sourcing speed tenfold with Inven. Before, analysts spent hours compiling lists, translating filings, and validating data. Now, the team has built a scalable sourcing workflow that cuts the process from a full day to less than 30 minutes: directly translating into more meetings, faster coverage, and stronger deal flow.

- Crossroads Capital streamlined its entire sourcing framework and tool set, achieving a dramatic 80% reduction in search time. Lists that used to take weeks are now ready in hours, which enables analysts to dive into evaluation and engagement much faster.

The common theme is speed and coverage. Where traditional methods created bottlenecks, modern workflows deliver complete lists quickly enough to act on them.

-Thomas Archer, Investment Analyst at Lexar Partners

A Practical Framework for Finding PE-Backed Companies

For dealmakers looking to upgrade their sourcing, a few steps make the process more systematic:

- Start with a clear thesis. Define the mandate with precision: sector, geography, size, and ownership. Instead of “software,” specify “€2–10M EBITDA B2B SaaS in Benelux.”

- Search beyond rigid industry codes. SIC or NAICS codes rarely capture niche definitions. Use intent-driven descriptions: “cybersecurity SaaS backed by PE” surfaces more relevant companies than a generic software filter.

- Incorporate local language sources. In Europe especially, PE transactions are often announced only in Dutch, German, or French press releases. Without multilingual search, important targets are easy to miss.

- Prioritize by hold period. A company acquired six years ago is far more likely to be preparing an exit than one acquired last year. Filtering by investment date adds focus to outreach.

- Enrich and validate. Export clean lists that already include ownership details and decision-maker contacts, so analysts can shift immediately into outreach and client discussions.

Every step above is built into Inven. Try it to see how finding PE-backed companies moves from days to minutes: Try Inven.

The Role of AI-Native Sourcing

AI is reshaping how investment banks approach sourcing. Instead of relying solely on static databases, AI-native platforms aggregate data from across the web — company sites, press releases, registries, and social signals — and interpret it in context.

Natural language search allows analysts to describe what they want in plain English (or any language) rather than navigating rigid filters. Machine learning models improve over time, surfacing increasingly relevant results. And critically, ownership data is built in: searches can return only sponsor-backed firms, saving hours of manual validation.

For IB teams, the impact is immediate. A list that once took days to assemble can now be generated in minutes. Instead of spending time finding companies, analysts spend time engaging with them.

How to Find PE-Backed Companies in Any Niche with Inven

One of the emerging platforms using these capabilities is Inven – the first AI-native company search and deal sourcing platform. Inven combines generative AI with proprietary data on 21 million companies and advanced algorithms, helping M&A teams find, analyze, and connect with the right targets 10x faster.

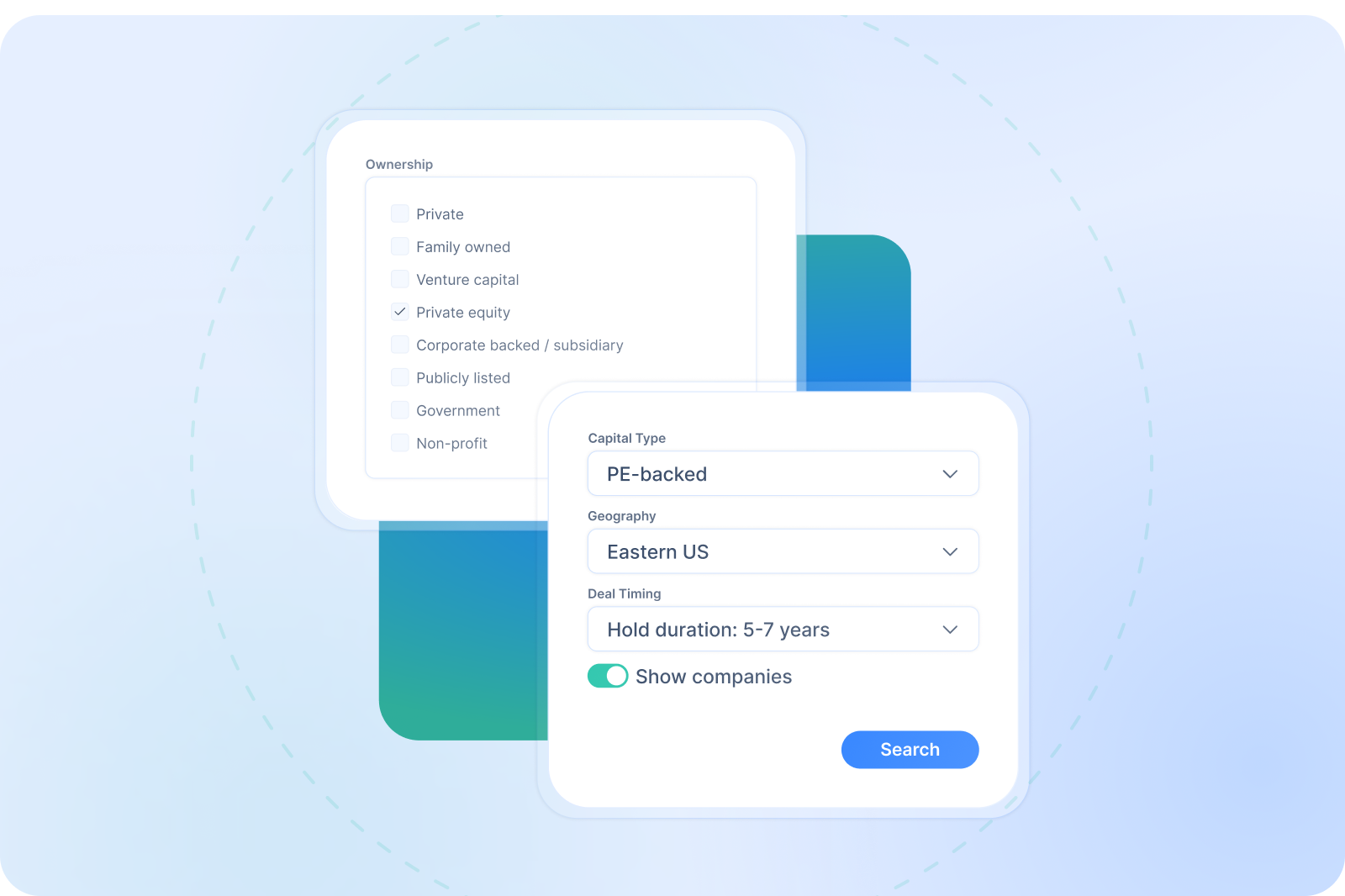

To illustrate how an AI-driven approach works, here’s an example of using Inven to find private equity-backed companies in a specific niche:

Define, Filter, and Enrich Your Search

- Start with an Example Company: Pick a reference company that operates in the niche you’re interested in and is similar to the type of target you want. For instance, if you are looking for PE-backed companies in the specialty pet food sector, you might use a known company from that space (even if it’s not PE-owned) as a model for the search. This helps the AI understand the business model and sector context.

- Describe the Niche in Natural Language: Enter a description of your niche or target criteria in your own words. Be as specific as necessary – e.g., “organic pet food manufacturers in Europe”. There’s no need to figure out official industry codes or exact keywords; simply describe the segment, geography, or other traits that matter. You could also include the kind of ownership if you want (but in this case, you’ll use a filter for that in the next step).

- Apply a “PE-Backed” Filter: Refine the search by selecting filters. Inven and similar tools allow filtering results by ownership type, so you would choose “Private Equity backed” as a filter. You might add other filters too, such as company size (if you only want, say, mid-sized firms) or location (country or region) if not already specified. Then run the search and enrich with AI.

Within seconds, the platform will return a list of companies that match your niche description and are flagged as having private equity owners.

For example, you could get a list of PE-backed organic pet food companies across Europe, or PE-backed healthcare IT providers in California, depending on your query. The results will include firmographic details and often the name of the PE sponsor or the date of the investment.

Inven’s results are also exportable and integrate with CRM’s and other AI solutions, meaning you can quickly get a spreadsheet of these targets for your further analysis or outreach.

The Scale of the PE-Backed Opportunity

Beyond efficiency, there are fundamental reasons PE-backed companies are attractive targets. They tend to be better capitalized, with governance structures and financial reporting that simplify diligence. They are often pursuing bolt-on acquisitions themselves, making them both potential buyers and sellers. And they are managed with a clear eye on exit value, meaning that timing is usually aligned with the interests of bankers seeking mandates.

Scale in Europe and the U.S.

In Europe alone, there are an estimated 25,000 PE-backed companies, most of them in the small and mid-market segment.

And in the EU‑4 countries (UK, Germany, France, Italy), the lower mid-market contributes over €1.11 trillion in GDP, illustrating a sizable and investable segment. Over the next two to three years, many of these will come to market as sponsors seek liquidity. For banks prepared with comprehensive coverage, that represents billions in potential deal flow.

In the U.S., the number of PE-backed companies has grown from about 2,000 in 2000 to over 11,500 by 2022 — a fivefold increase in just two decades. Moreover, current PE holdings span approximately 30,000 companies valued at $3 trillion+, many held for longer-than-usual periods, locking in opportunities for dealmakers.

Conclusion

The days of stitching together PE-backed company lists from databases, Google searches, and spreadsheets are fading. Speed and accuracy define who wins mandates.

For investment banks, moving from manual research to AI-native sourcing turns deal origination from a bottleneck into a competitive advantage. Instead of spending days chasing incomplete data, analysts can now deliver complete, enriched buyer or target lists in under an hour.

In a business where timing is everything, mastering the ability to identify PE-backed companies in specific niches is a real dealmaking edge.

Try Inven

Founded in 2022 and trusted by 800+ private equity firms, investment banks, consulting firms, and VCs, Inven is the first AI-native deal sourcing platform built to uncover opportunities across the global private market. With proprietary data on 21M companies, Inven helps M&A teams source, analyze, and connect with the right targets 10× faster.

Stay ahead with:

🟦 Access to 21M companies worldwide

🟦 Predictive signals to spot opportunities before competitors

🟦 AI-powered search that makes sourcing and research 10× faster

Start your free trial today to see Inven in action.