AT A GLANCE

Key results

Since starting to use Inven, Imbiba has seen clear improvements in origination and efficiency:

- 4–5× faster list building

- Higher relevance of companies surfaced, leading to better-fit conversations

- New subsectors identified and mapped

PROBLEM

From sporadic scraping to systematic origination

Before Inven, deal origination and market mapping were slow and inconsistent. Analysts scraped sector websites, searched directories, and relied on ad-hoc tips from advisors. Traditional databases were tested, but often returned companies that were too small or irrelevant.

“We’d spend hours scraping sites and still end up with either one-location businesses or giant conglomerates — nothing that really fit our model", says Andrew Guest, Investment Analyst at Imbiba.

This meant days of effort for a handful of relevant opportunities, and entire subsectors were almost impossible to map systematically.

SOLUTION

Why Inven stood out

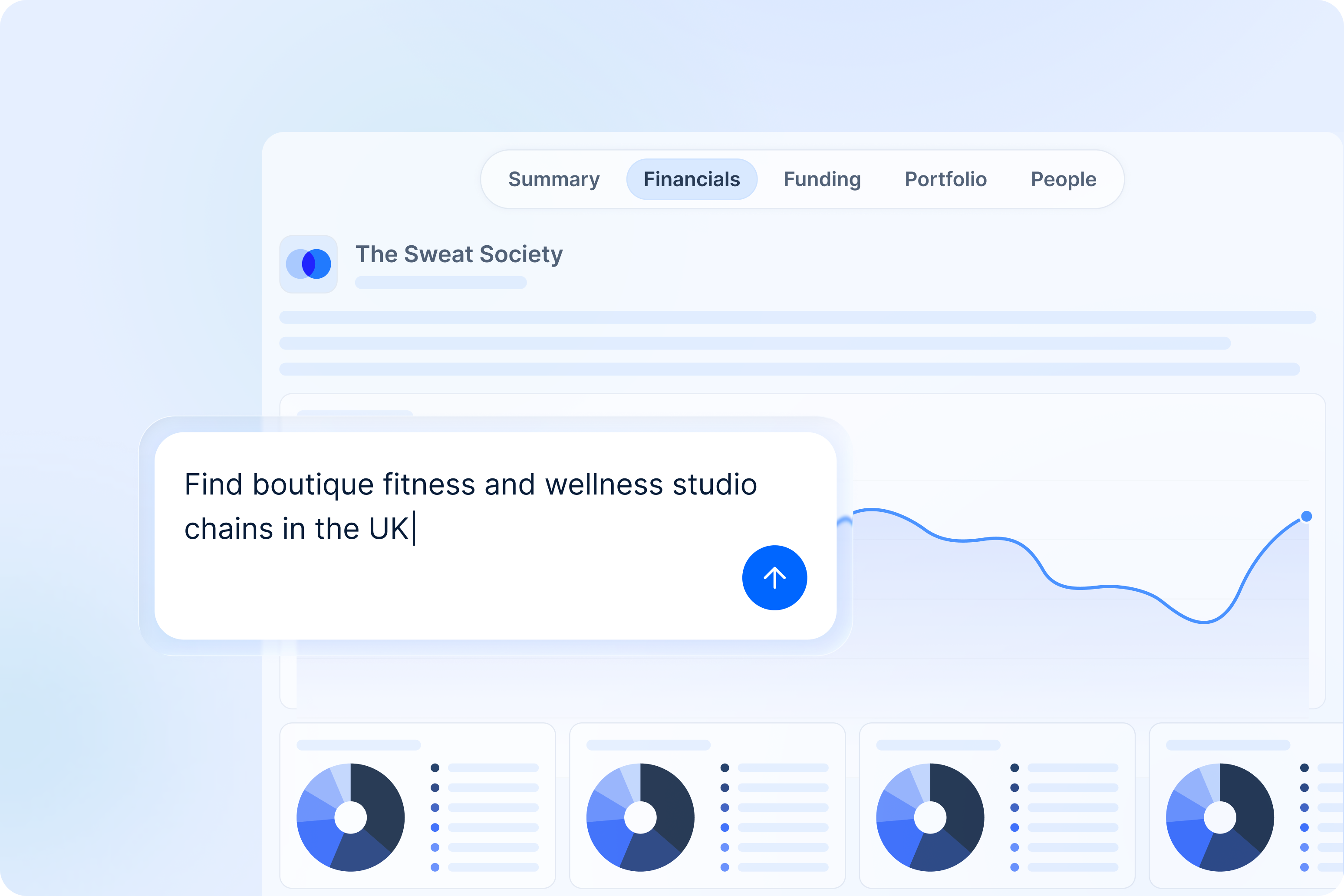

A trial quickly showed Investment Analyst Andrew Guest the difference between Inven and traditional M&A platforms. The AI screener allowed him to ask precise questions and refine lists in minutes. Features like “similar companies” expanded one good match into a robust longlist, while the export function made lists easy to share.

“The AI screener stood out immediately. I could ask precise questions and refine my lists in minutes. The search, screening, and quick list-building features made it the most effective platform we’d tried.”

USE CASES

How Imbiba uses Inven across the investment workflow

Imbiba relies on Inven not only for faster deal origination, but also for early-stage due diligence checks and even validating commercial strategies.

Deal origination: Better-fit targets and more subsectors

Imbiba now uses Inven as a primary origination tool. Andrew spends several hours each week creating and refining lists of targets that fit Imbiba’s investment model.

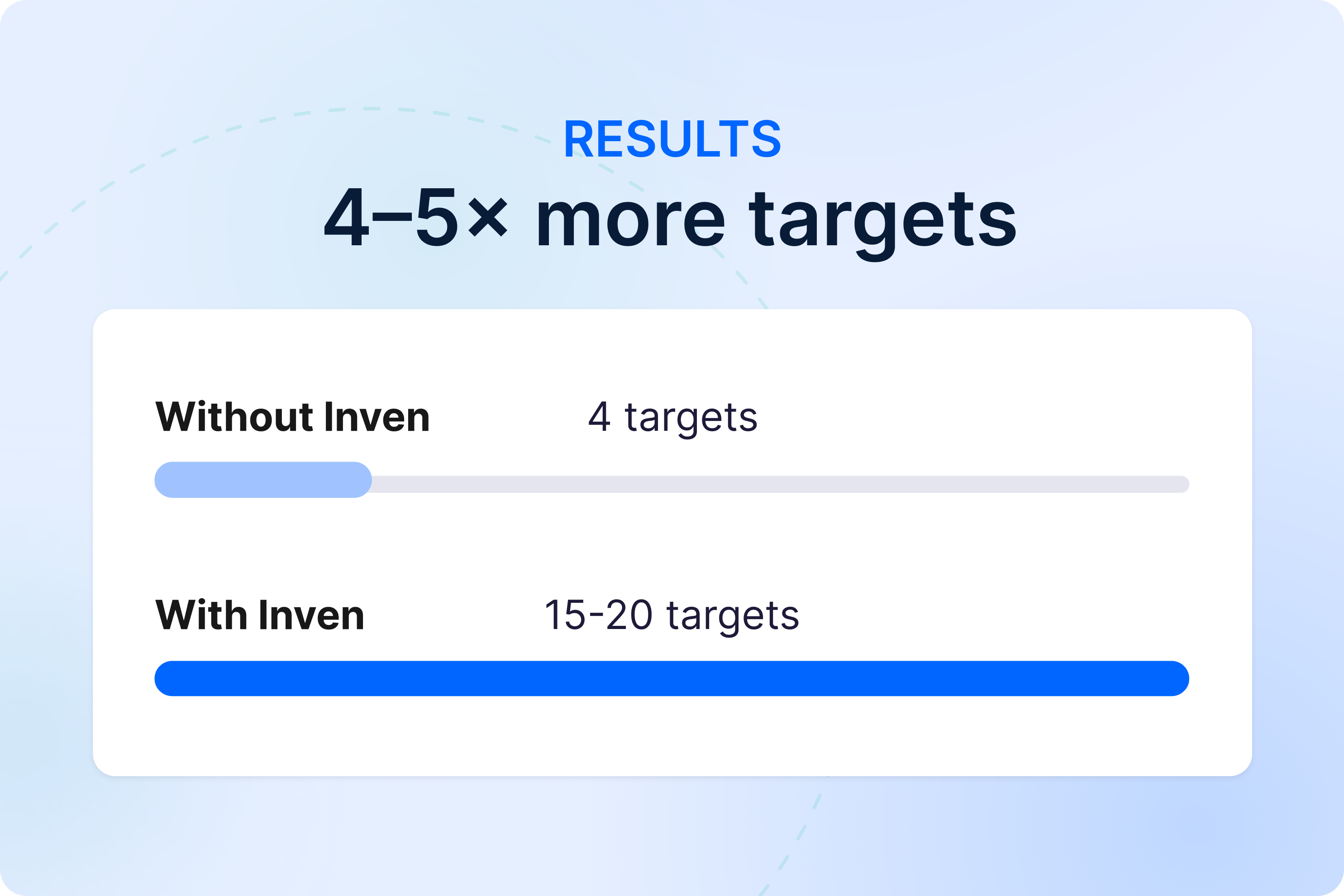

“In a typical three-hour session, I’ll find 15–20 companies to contact. Before Inven, I would have been lucky to find four. It’s four to five times faster with Inven.”

Each Monday, Andrew creates a new list to track companies. This structure provides visibility to senior colleagues and ensures sourcing output can be measured and reused.

Inven has also unlocked new subsectors. Recently, Andrew mapped luxury travel operators offering curated group experiences. Without Inven, this research would have been almost impossible.

Early-stage due diligence: Quicker financial checks

Imbiba uses Inven’s private-company financials to quickly check balance sheets and revenue estimates, with direct links into official company filings. This makes it simple to validate key figures in early-stage due diligence without the need to search multiple sources.

Market validation: Testing commercial strategies

Imbiba also uses Inven to support workflows outside of deal sourcing.

For example, when assessing a potential investment in a consumer product business, Andrew exported a list of relevant venue operators with contact details. This allowed the property director to approach operators directly and test whether there was appetite for placing the product in their locations.

“That export alone saved him hours of manual work. Instead of hunting for names, he could get straight to outreach and validate whether the placement strategy made sense.”

By quickly mapping a market segment, Inven helped the team validate a go-to-market hypothesis and reduce the time spent on early commercial testing.

RESULTS

Measurable impact

Since starting to use Inven, Imbiba has seen clear improvements in origination and efficiency:

- 4–5× faster list building

- 15–20 high-quality targets identified in hours

- Higher relevance of companies surfaced

- New subsectors identified and mapped

- Time savings across the team with exportable lists

- Improved visibility through weekly sourcing

About Imbiba

Imbiba invests growth capital in UK and Irish location-based brands in leisure, education, and healthcare. As operator-investors, Imbiba supports its portfolio companies in areas such as property, operations, finance, recruitment, procurement, marketing, and social media — helping grow their businesses while managing investment risk.